Describe Five Different Types of Bonds

Bills debt securities maturing in less than one year. If an atom has too few or too many valence electrons it will have to gain lose or share those outer electrons with another atom in order to become happy or in chemistry terms more stable.

Covalent Bond Definition Types And Examples

If you or a loved one need to post bail then you should know that there are several different types of bail available and each can be tailored to fit both the charges being faced and the accuseds financial situation.

. Covalent bonds can be single double and triple bonds. Bonds debt securities maturing in more than ten years. These bonds vary in their strengths.

Speculative-grade bonds are bonds that have been assigned to one of the lower ratings BB and below by Standard and Poors Ba and below by Moodys. Bid or surety bonds guarantee the successful bidder will accept the contract. Prev Article Next Article.

Notes debt securities maturing in one to ten years. Chemical bonds are classified into four groups. The covalent linkage between two amino acid units in a polypeptide.

An attraction between two ions with opposite electrical charges. The octet rule states that an atom is most stable when its valence shell has eight electrons. Covalent bonds form between two non-metal atoms.

Different Types of Bonds Government Bonds. Obtaining at least one electron from a different atom. Heres a list of the main categories of bonds.

In general fixed income securities are classified according to the length of time before maturity. 12 year term or more. Describe five different types of bonds.

If you plan to invest in bonds you have a lot of options. Find step-by-step Economics solutions and your answer to the following textbook question. Aaa through Baa by Moodys.

Investment grade bonds are bonds that have been assigned to one of the top four ratings AAA through BBB by Standard and Poors. Describe which combinations of what types of atoms are expected to form which types of bonds make reference to location on the periodic table Describe some of the qualitative properties of materials that have these types of bonds b Describe. The day the bond comes due.

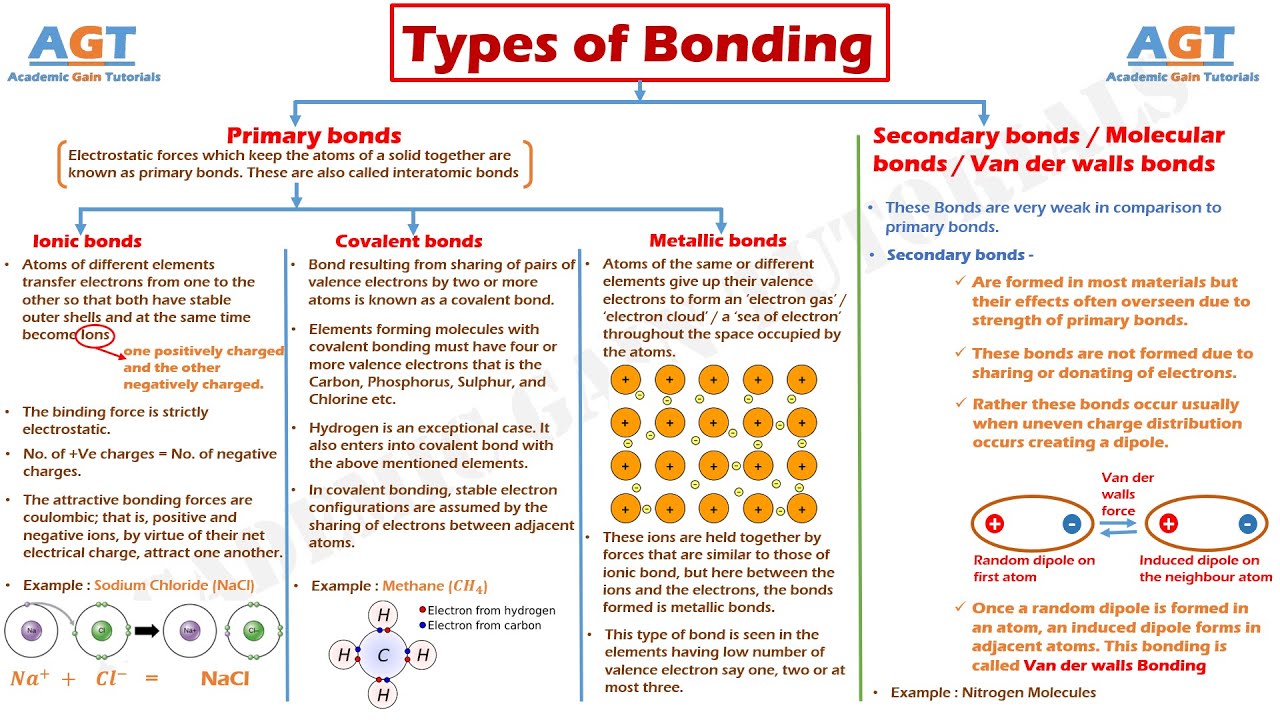

There exist four primary types of chemical bonds as listed below. Ionic bonds also known as electrovalent bonds. Types of Chemical Bonds.

A convertible bond is a type of corporate bond that the holder can convert into shares of the issuing company at any time. Double bonds occur when four electrons are shared between the two atoms. Floating rate bonds have a fluctuating interest rate coupons as per the current market reference rate.

A 30-year bond for example comes due 30 years from the day it is issued. These are the three main categories. A bond is just a financial instrument that says that the bond issuer owes a sum of money to the bond owner.

There are four types of chemical bonds essential for life to exist. Metallic bonds form between two metal atoms. A bond lender is any organization firm or individual that has cash to lend.

Chemical bonding a Qualitatively describe five different types of chemical bonds and why they occur. As a result bonds can come in a wide range of forms with a wide range of terms meaning that interested individuals need to make sure that. Garrett Parker 3 years ago.

Performance bonds guarantee the work of the successful bidder meets specifications and in the time specified. Ionic or electrovalent bond. Nonpolar covalent bonds form when the electronegativity values are very similar while polar covalent bonds form when the electronegativity values are a little further apart.

Covalent bonds also known as molecular bonds. Terms in this set 5 Ionic bond. Single bonds occur when two electrons are shared and are composed of one sigma bond between the two atoms.

Hydrogen bonds often abbreviated to H-bonds. Owing to a constant interest rate fixed rate bonds are resistant to changes and fluctuations in the market. In Fixed Rate Bonds the interest remains fixed through out the tenure of the bond.

Formed by a dehydraton reaction. Following are the types of bonds. Answer 5 Chemical bonds are broadly catagorized into two main types - A Ionic bonds.

Ionic Bonds Covalent Bonds Hydrogen Bonds and van der Waals interactions. A borrower is a business or a governmental entity that requires cash to finance. Five year term or less.

Maturity between five and 12 years. Reading- The Different Types of Bonds Atoms form bonds with other atoms in order to have a full outer shell of electrons like the noble gases. The number of shares you get when you convert the bond are predetermined.

Most bonds mature within 30 years but maturities can be as short as a year or. Ionic bonds are formed when two atoms share electrons such that the atom which looses an electron gains a positive charge and is known as cation whereas an atom View the full answer. The electrical attracton of the opposite chrages holds the ions together.

Seven Different Types of Bonds Explained. A brief description of the different types of chemical bonds can be found below. We need all of these different kinds of bonds to play various roles in biochemical interactions.

Click Here To See The Comments. Simply put a bond is a loan from a lender to a borrower aka an issuer. And payment bonds protect the buyer against any third - party liens not fulfill by the bidder.

By transferring one electron to another atom. A bond is an instrument of debt that functions both as an investment and a loan. Polar covalent bonds also known as polar bonds.

Crystal Types Of Bonds Britannica

No comments for "Describe Five Different Types of Bonds"

Post a Comment